Housing and Economic Development Bond

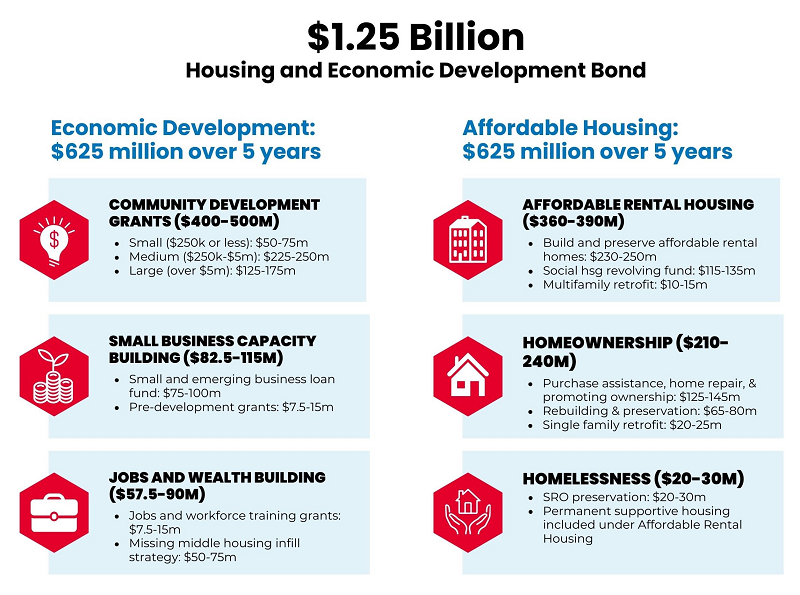

$1.25 Billion Housing and Economic Development Bond (2024-2028)

Mayor Brandon Johnson is committed to fostering a prosperous and inclusive Chicago for all by making strategic investments in people, businesses, and neighborhoods. Through the implementation of the community development plans below, the administration will create a vibrant and dynamic economy that fosters prosperity and opportunity for all residents and strengthens the city as a leader of innovation, creativity and sustainable growth. Mayor Johnson is committed to creating a prosperous and inclusive economy that provides all Chicagoans access to jobs, housing, arts and culture, and other neighborhood amenities.

In order to move Chicago closer to this vision, the Johnson administration is investing $1.25 billion over the next five years. Made possible by a bond issuance, proceeds will be allocated toward three primary pillars: Housing; Business, Innovation and Job Growth; and Cultural and Community Assets.

Click here to download the strategic plan for Mayor Johnson's $1.25 billion Housing and Economic Development Bond (2024-2028).

Housing is a human right. All Chicagoans should have access to safe, stable housing options, contributing to improved quality of life, economic opportunity, and community well-being for generations to come.

Businesses are the backbone of the economy and can create opportunities for residents to improve their quality of life by fostering innovation, driving economic resilience, and promoting equitable wealth distribution.

Community and culture are at the core of the Soul of Chicago and comes to life in the vibrancy of our neighborhood places, spaces, and events. Every resident should have access to a thriving, walkable, and economically resilient commercial corridors that creates a vibrant local economy filled with activity, commerce, and culture, fostering a sense of pride, belonging, and opportunity for all residents.

The investments described in this document will be funded through the issuance of General Obligation (GO) and Sales Tax Securitization Corporation bonds. Their proceeds will be primarily tax-exempt, but as much as 35 percent of the issuance will be taxable in order to deploy funds towards revolving loans and other non-capital expenses.

The City will augment these funds through existing City funding sources, including Affordable Requirements Ordinance (ARO) n-lieu fees, Low-Income Housing Tax Credits (LIHTC), Neighborhood Opportunity Fund (NOF), and Tax Increment Financing (TIF), as well as additional federal and state grants and private funding in order to maximize the City’s investment in our neighborhoods over the next five years. In total, this represents upwards of $3 billion of investment in the City of Chicago, including more than $1.75 billion in economic development investments and $1.25 billion in housing investments.

The bond program will not require extending additional property taxes to City residents. Instead, as TIF districts expire and there is a related increase to the overall tax base, there will be a correlated increase to the amount of property taxes received by the City. General Obligation Bonds are issued with a property tax levy and the share of the tax levy from the expired TIF districts will accrue to the corporate fund and will be available for debt service, allowing for the GO bond levy to be abated.