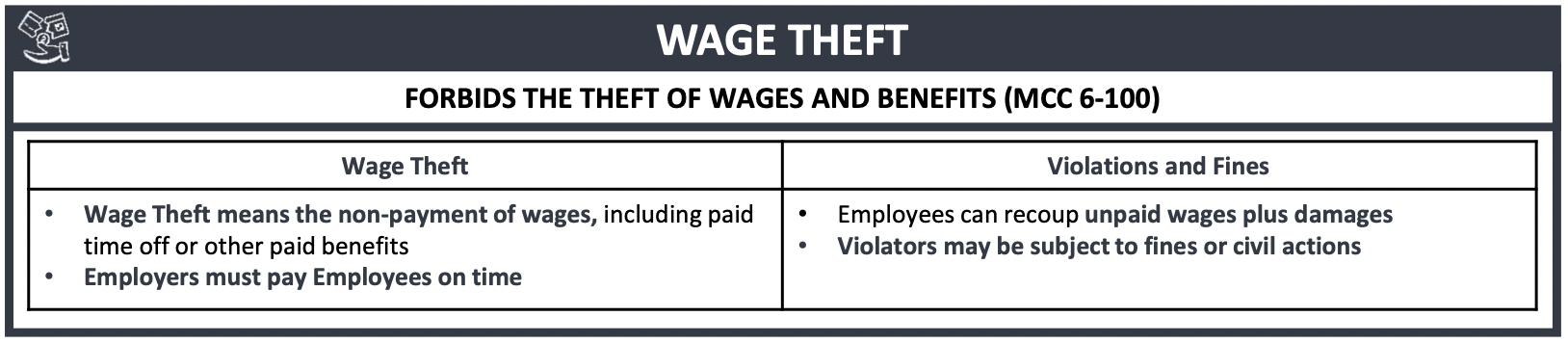

Wage Theft

Your employer must pay you your full wage and agreed upon benefits in a timely manner. If your employer is paying you less or not at all, this may be wage theft. Almost $400 million in wages are stolen from Chicagoland workers by employers every year. The Office of Labor Standards can recoup stolen wages and benefits for workers.

Public Notice

Every employer must post in a conspicuous place at each facility located in the City of Chicago a notice advising the Covered Employee of:

- Current minimum wage

- Fair Workweek (if applicable)

- Paid Leave and Paid Sick Leave

- Wage Theft

With the first paycheck issued to a Covered Employee, and annually with a paycheck issued within 30 days of July 1st, every employer must provide a notice advising the Covered Employee of:

- Current minimum wage

- Fair Workweek (if applicable)

- Paid Leave and Paid Sick Leave

Retaliation for filing a complaint with Office of Labor Standards is prohibited.

Employers that do not maintain a business facility within the geographic boundaries of the City and households that serve as the worksites for Domestic Workers are exempt from MCC 6-105-070(a) (the posting requirements).

Resources

File a Complaint by calling 311, using CHI 311, or by filling out a Complaint Form.

ARCHIVE UNA DEMANDA / SKŁADANIE ZAŻALEŃ / 提交投诉 / MAGHAIN NG REKLAMO / 항의 제출

For visually impaired individuals, or those using a screen reader, please complete this Accessible Complaint Form. If you are unable to complete the complaint form, please call (312) 744-2211 or email bacplaborstandards@cityofchicago.org for assistance.