Opportunity Zones

Frequently Asked Questions

What is an Opportunity Zone?

According to the IRS, an Opportunity Zone is an economically-distressed community area where new investments may be eligible for preferential tax treatment. Community areas qualify as Opportunity Zones if they have been nominated by the state and certified by the U.S. Treasury. Opportunity Zones must be created within low-income communities as defined by Section 45D(e) of the Internal Revenue Code—census tracts with a poverty rate of at least 20 percent or where the median family income does not exceed 80 percent of statewide median income. A maximum of 25 percent of a state’s low-income census tracts may be designated as Opportunity Zones.

How did Chicago decide which areas to recommend as Opportunity Zones?

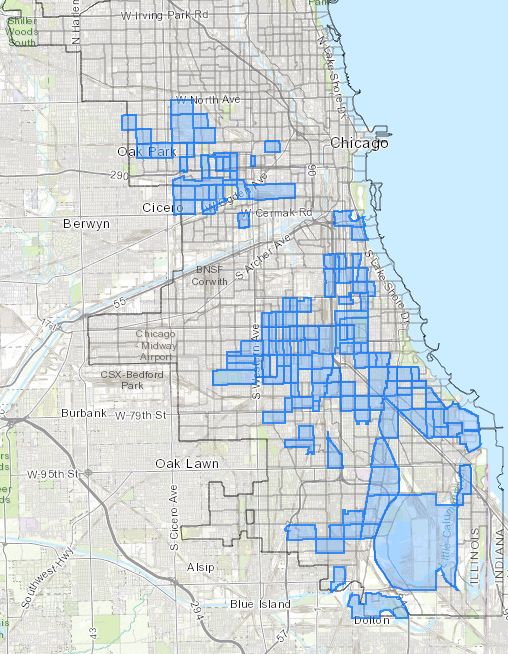

The City of Chicago recommended 133 census tracts — out of more than 500 eligible tracts in the City — to the State of Illinois for designation as Opportunity Zones, as well as two additional tracts that make up the former Michael Reese Hospital site. The selection of the 133 census tracts focuses on areas of the city in greatest need, using data from the 2011-2015 U.S. Census Bureau’s American Community Survey (ACS). The City used the following factors to select the tracts:

- Unemployment rate of 20 percent or more

- Median family income of less than $38,000, which is approximately 50 percent of Area Median Income

- Poverty rate of 30 percent or more

The City consulted with aldermen to confirm that the identified tracts within communities with these three qualifying factors were also the tracts that had the most investment potential. In certain limited instances, eligible tracts from within the same community in which economic development activity is underway or which eligible tracts are adjacent to a tract in which development is underway were strategically exchanged.